Halo ... Jika Anda tertarik untuk bergabung dengan proyek INSURANCE CRYPTOCOIN atau Anda tertarik untuk bergabung dengan proyek ASURANSI CRYPTOCOIN, adalah ide bagus untuk membaca yang dapat membantu Anda menemukan informasi yang mungkin membantu Anda dalam melihat visi dan misi mereka selama PROGRAM ASURANSI CRYPTOCOIN.

Tentang proyek

Pilihan adalah derivatif keuangan yang dijual oleh penulis opsi untuk pembeli opsi. Kontrak menawarkan kepada pembeli hak, tetapi bukan kewajiban, untuk membeli (opsi panggilan) atau menjual (put option) aset yang mendasari pada harga yang disepakati selama periode waktu tertentu atau pada tanggal tertentu. Harga yang disepakati disebut harga strike. Ada banyak tipe opsi. Satu opsi dapat dilakukan kapan saja sebelum tanggal kedaluwarsa opsi, sementara opsi lain hanya dapat dilakukan pada tanggal kedaluwarsa (tanggal latihan). Berolahraga berarti memanfaatkan hak untuk membeli atau menjual keamanan yang mendasarinya.

Terdengar sangat sulit! Itulah mengapa proyek ini dibagi menjadi dua bagian: pertukaran opsi dan perusahaan asuransi ..

Pedagang dan hedge fund menyimpulkan transaksi pembelian dan penjualan opsi saham

Klien lain, yang tidak ingin tahu cara kerja opsi dapat membeli asuransi untuk pertumbuhan atau jatuhnya mata uang kripto utama.

Klien membayar asuransi dalam jumlah 0,1 Bitcoin untuk deposit dalam jumlah 3 Bitcoin. Jika harga turun 15% dalam 3 hari, dia berhak untuk mendapatkan asuransi dalam jumlah setoran jatuh - 0,45 Bitcoin. Dalam hal asuransi, CRYPTOCOIN ASURANSI membayar klien asuransi dari asuransi yang diperoleh sebelumnya. Jika belum ada acara asuransi, asuransi yang dibayar oleh klien akan menjadi pendapatan perusahaan.

ASURANSI CRYPTOCOIN memungkinkan Anda untuk memastikan harga jatuh atau risiko pertumbuhan untuk cryptocurrency utama.

Masalah: Tidak ada solusi untuk memastikan simpanan di Bitcoin atau Ethereum agar tidak jatuh. Pada saat yang sama di pasar ini ada peningkatan volatilitas yang membuat orang takut menyimpan dana besar dalam cryptocurrency. Di sisi lain, perusahaan besar lambat untuk memasuki pasar (misalnya, untuk menerima pembayaran dalam cryptocurrency) karena alasan yang sama.

Solusi: Pertukaran akan mulai beroperasi dengan 5 cryptocurrency yang memiliki pasar maksimum. Selanjutnya, seiring meningkatnya permintaan dan omset, kami akan menambahkan mata uang kripto lainnya. ASURANSI CRYPTOCOIN menjual baik pertumbuhan Bitcoin atau Ethereum dan asuransi jatuh. Dengan demikian, itu melindungi risikonya. Tidak ada persaingan di pasar yang memungkinkan mempertahankan marjin yang signifikan pada level 20%. ASURANSI CRYPTOCOIN mengemas ulang dan menjual / membeli risikonya sendiri sebagai opsi dalam pertukarannya sendiri.

ASURANSI CRYPTOCOIN meluncurkan pertukaran mata uang cryptocurrency pilihan pertama di dunia

Masalah: Tidak ada pertukaran mata uang cryptocurrency khusus di mana Anda dapat membeli / menjual opsi. Ketakutan utama untuk menciptakan bursa saham semacam itu adalah meningkatnya volatilitas juga. Tampaknya semua orang yang berurusan dengan opsi untuk saham, minyak atau gandum bahwa risikonya sangat besar.

Solusi: Ketakutan utama dari opsi di pasar cryptocurrency adalah peningkatan volatilitas. Tapi benarkah itu?

Mari kita pertimbangkan contoh dengan pasar saham kebiasaan. Misalnya, klien menjual opsi untuk bagian dari Perusahaan ZZZ. Hari ini hari Sabtu, dan pasar tutup. Ada kabar baik yang tak terduga dan saham tumbuh 2-10 kali pada pembukaan pasar pada hari Senin. Pada gilirannya, penjual opsi menderita kerugian besar.

Keuntungan dari pasar cryptocurrency tidak seperti saham atau komoditas adalah bahwa ia beroperasi 24 jam sehari. Dan untuk seluruh periode keberadaannya (sekitar 10 tahun), tidak pernah ada berita yang dengan cepat akan menggeser harga Bitcoin atau Ethereum setidaknya 30-50%. Bahkan, jika hanya chip biru (koin), pasar cryptocurrency jauh lebih aman untuk penjual opsi daripada pasar lain yang kita terbiasa.

Pilihan memungkinkan penjualan singkat

Masalah: Masih belum ada peluang penjualan singkat di pasar cryptocurrency. Tidak ada yang bisa menjual cryptocurrency yang secara fisik tidak ada di akun dalam waktu singkat. Ini mengurangi kemampuan spekulan untuk memperlancar fluktuasi harga di pasar lain. Pada gilirannya itu menyebabkan peningkatan volatilitas dan konsekuensi yang disebutkan dalam kl. 1 dan 2 di atas.

Solusi: Tanpa memiliki fisik Bitcoin atau Ethereum, adalah mungkin untuk mendapatkan opsi untuk jatuh, dan benar-benar melaksanakan penjualan yang tidak terungkap. Kesempatan ini membawa ke pasar banyak pedagang baru, investor dan spekulan, serta hedge fund yang menempatkan uang tidak hanya pada pertumbuhan tetapi juga pada jatuhnya pasar.

Kenapa sekarang?

Ada sekitar seribu pertukaran dan tidak ada pertukaran opsi

Pesatnya pertumbuhan bunga hedge fund ke cryptomarket tidak puas karena kurangnya pilihan dan kemungkinan penjualan yang pendek

Kami telah mengumpulkan tim profesional yang tahu segalanya tentang pasar opsi dan siap untuk mewujudkannya bukan perubahan revolusioner tetapi inovatif

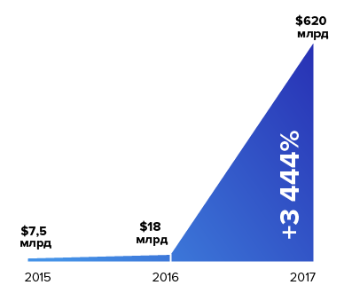

Ukuran pasar

Kapitalisasi pasar cryptocurrency berjumlah ratusan miliar dolar. Volume perdagangan harian berada pada level $ 10-20 miliar.

Ukuran pasar opsi untuk komoditas dan saham berbeda dari satu negara ke negara lain, dan adalah 1-5% dari jumlah pasar aset dasar. Dengan demikian, kita dapat menghitung volume potensial dari pasar opsi untuk cryptocurrency dasar dalam jumlah $ 50-250 juta per hari.

Namun, perhitungan tidak memperhitungkan bahwa opsi benar-benar memberikan peluang untuk penjualan singkat yang saat ini tidak dapat dilakukan pada pertukaran cryptocurrency. Ini akan berkontribusi pada peningkatan tambahan dalam permintaan penjual untuk instrumen.

Monetisasi

ASURANSI CRYPTOCOIN memiliki dua sumber utama pendapatan

Pertukaran Opsi

Keuntungan dihasilkan sebagai komisi perdagangan dari setiap operasi pada opsi pembelian atau penjualan. Ini adalah 0,5% per transaksi atau 1% per lingkaran untuk masing-masing pihak transaksi.

Dengan mempertimbangkan volatilitas opsi dan peluang besar untuk mendapatkan keuntungan, komisi ini tidak signifikan untuk pelaku pasar. Namun, hal ini memungkinkan pertukaran untuk mendapatkan penghasilan tinggi dibandingkan dengan pertukaran cryptocurrency yang biasa karena kurangnya kompetisi. Dalam hal pesaing di masa depan, jumlah komisi pertukaran dapat dikurangi secara proporsional.

Perusahaan asuransi

Pendapatan dihasilkan dengan menjual asuransi pertumbuhan / penurunan cryptocurrency.

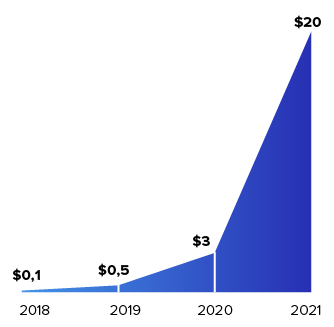

Potensi Pertumbuhan Token CCIN

Perusahaan ASURANSI CRYPTOCOIN telah mengembangkan model yang sederhana dan mudah dipahami untuk peningkatan nilai token CCIN. 30% dari setiap komisi yang diperoleh oleh pertukaran opsi akan diarahkan ke dana likuiditas. Dalam bulan berikutnya ASURANSI CRYPTOCOIN mengirimkan dana ini untuk membeli token CCIN dari pasar dan membakarnya.

Model bisnis ini diadopsi hanya untuk kepentingan investor kami. Janji untuk membeli token dari laba masa depan tidak bisa transparan. Selain itu, bursa atau platform mungkin tidak pernah mendapat keuntungan secara fisik. Dalam kasus token CRYPTOCOIN ASURANSI, investor tahu persis bahwa setiap transaksi pembelian / penjualan opsi menghasilkan arus kas yang digunakan untuk membeli token.

Hal ini memungkinkan secara konstan menggeser keseimbangan pasar dan meningkatkan permintaan akan token CCIN.

Jika omzetnya adalah $ 50 juta per hari, komisi untuk kedua sisi transaksi akan menjadi $ 500.000 atau $ 15 juta sebulan. 30% dari jumlah ini atau $ 5 juta dikirim setiap bulan untuk membeli token CCIN dari pasar.

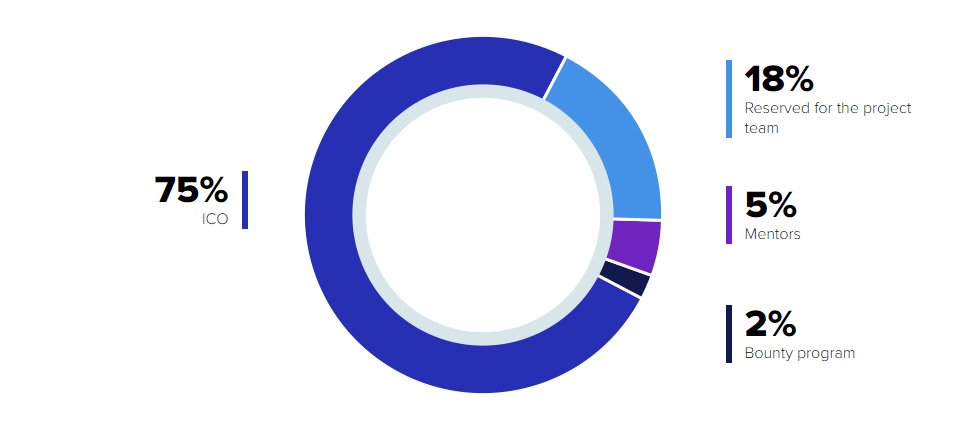

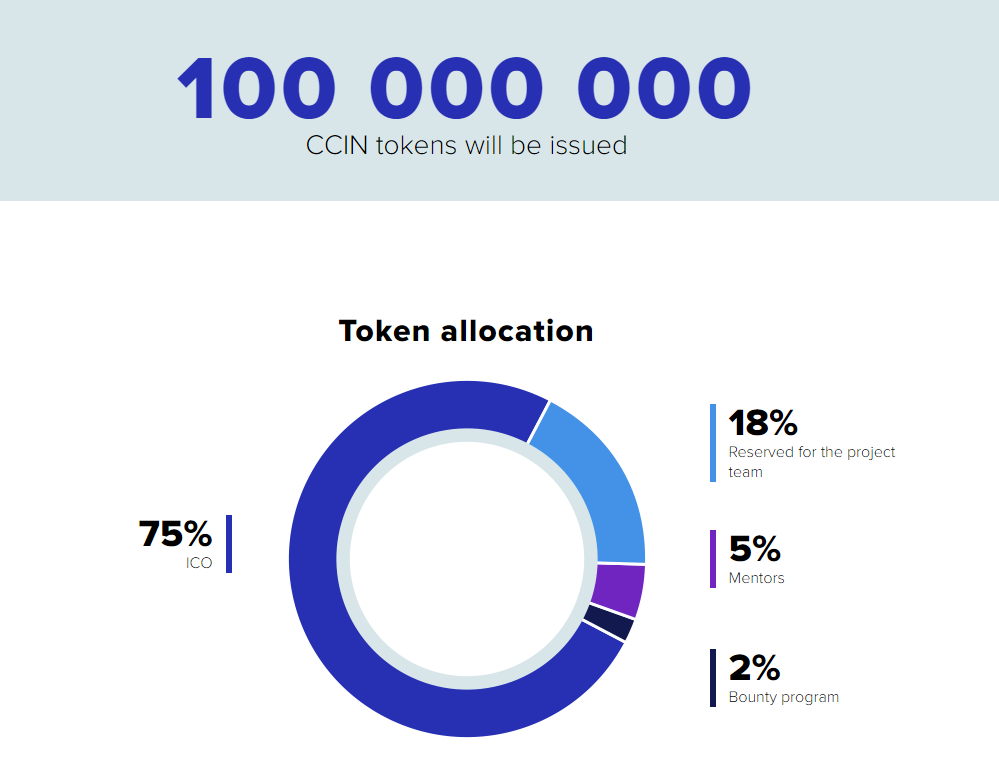

100 000 000

Token CCIN akan diterbitkan

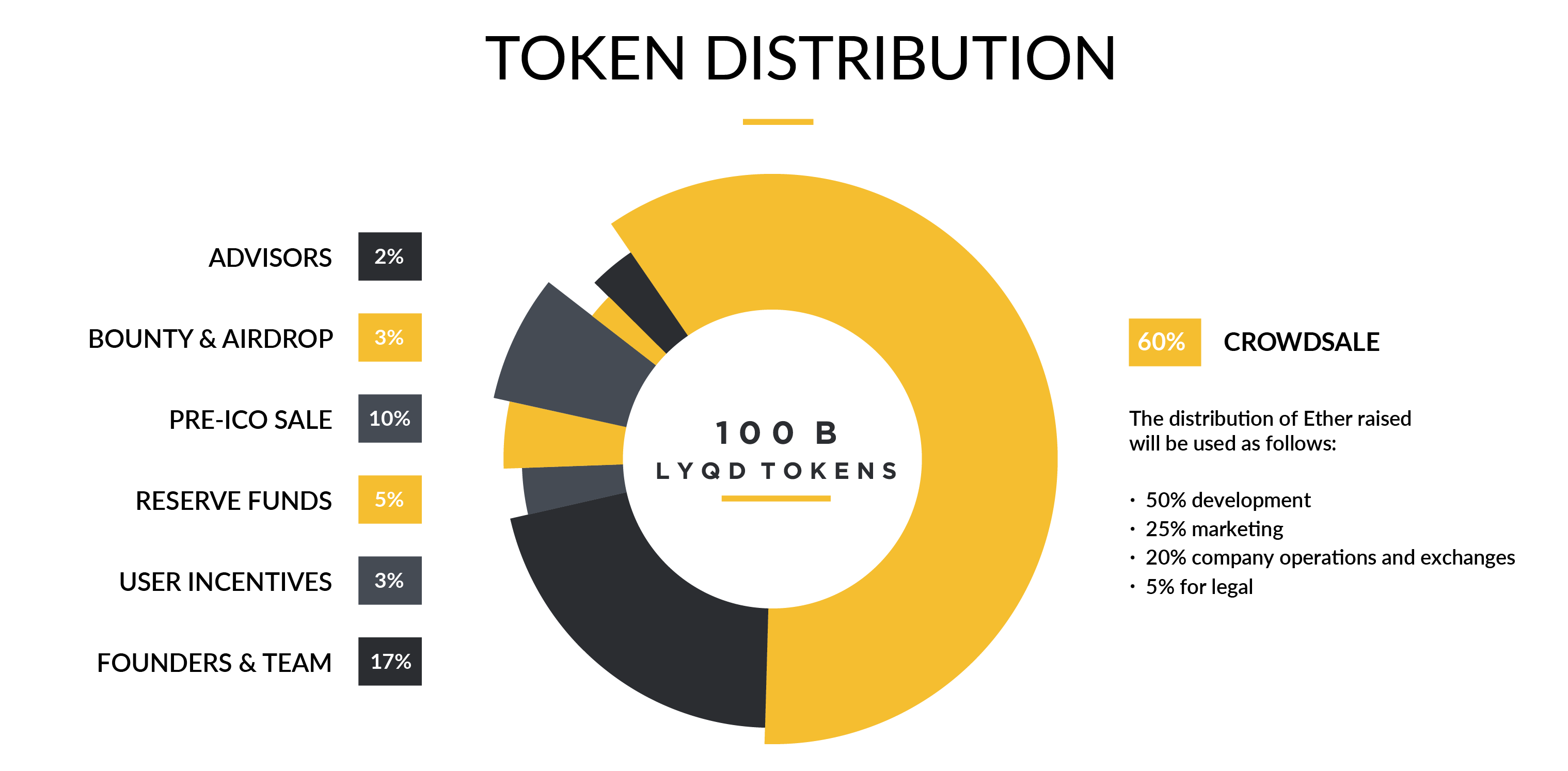

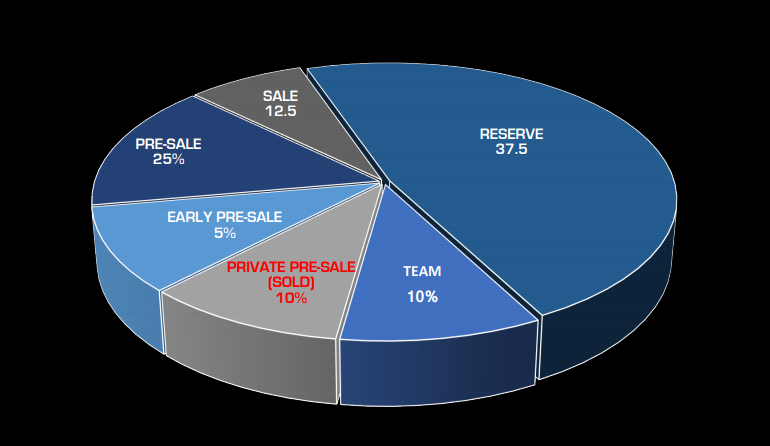

Alokasi Token

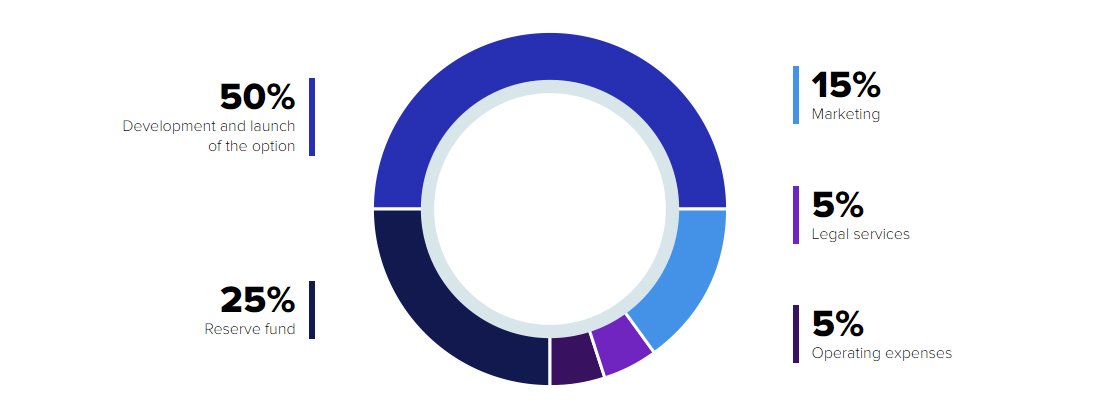

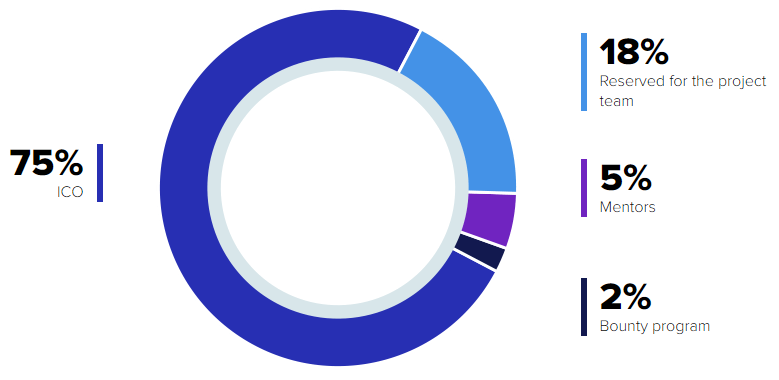

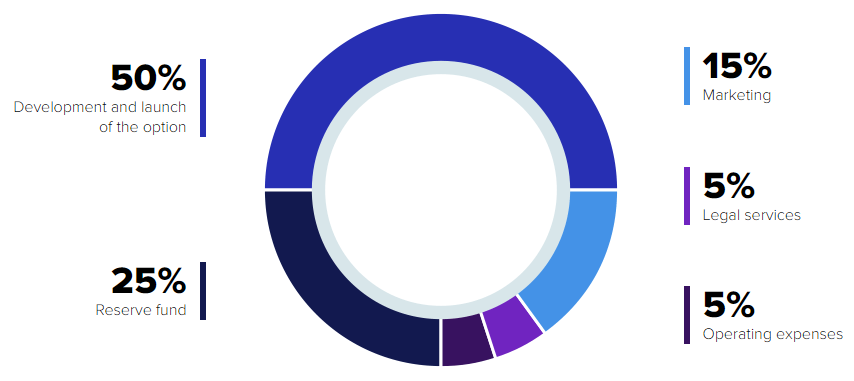

Alokasi dana yang terkumpul

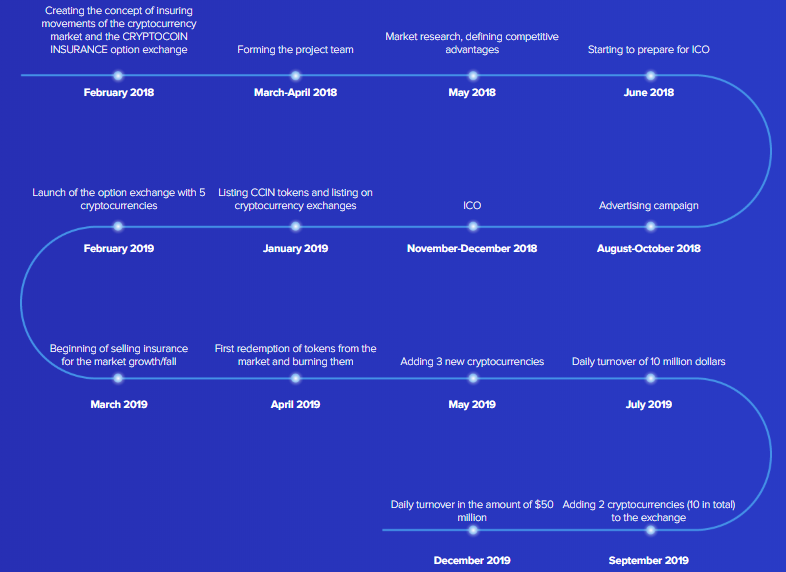

Peta jalan

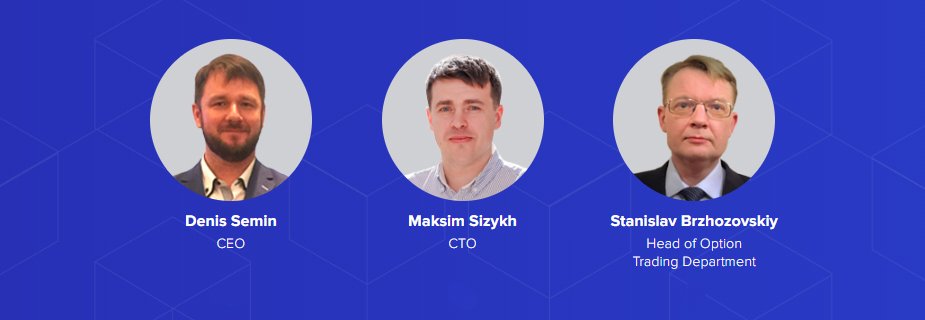

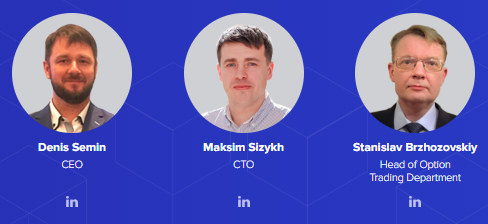

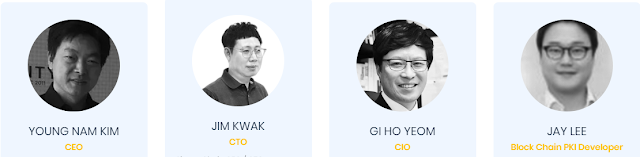

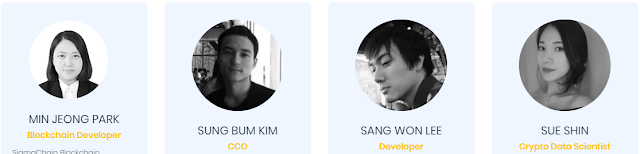

Proyek tim

Berikut adalah informasi yang saya sajikan kepada Anda dalam mencari informasi dan mengetahui proyek CRYPTOCOIN INSURANCE yang saat ini sedang dijalankan oleh tim mereka, jika ada kesalahan dalam menjelaskan artikel ini, jangan khawatir, saya telah menulis untuk mendapatkan informasi yang akurat. Informasi dan tentu saja Anda akan dapat berbicara langsung dengan atau tim meureka, di tautan.

Untuk informasi lebih lanjut dan bergabung dengan media sosial ASURANSI CRYPTOCOIN, harap ikuti panduan berikut ini:

Website:http://ccin.io/

Whitepaper:http://ccin.io/doc/Whitepapereng.pdf

Facebook:https://www.facebook.com/ccinofficial/

Twitter:https://twitter.com/ccin_official

Telegram:https://t.me/ccin_official

My profiel:https://bitcointalk.org/index.php?action=profile;u=1856275

Eth:0xF6BEC841b139F9Ab7Aa1826c518D3E1FBA785F36

''

''